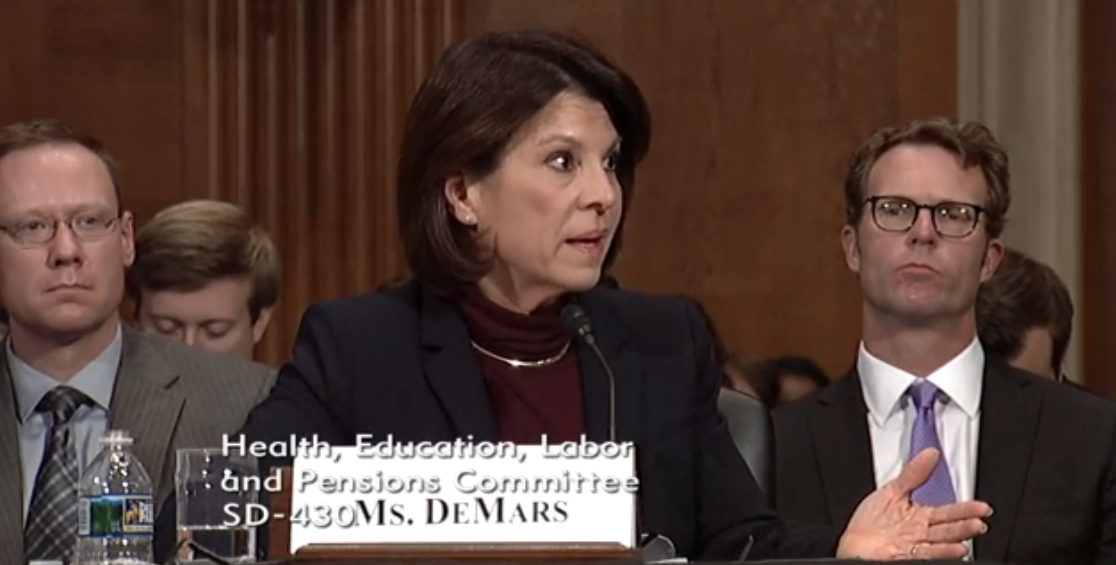

DeMars: Aggressive healthcare payment reforms needed

The federal government needs to push payment reform to curb healthcare costs, the leader of a cooperative representing self-funded employers in Wisconsin, Illinois and Iowa told senators Wednesday.

Cheryl DeMars, CEO of The Alliance, recommended that the Centers for Medicare and Medicaid Services continue to “pursue aggressive healthcare payment reform.”

Since the federal government is the largest purchaser of healthcare, its efforts can shape cost and care delivery for all patients, she said.

“We need CMS to keep their foot on the gas,” DeMars told members of the Senate Committee on Health, Education, Labor and Pensions.

In her written testimony, DeMars said that policymakers should consider concerns from healthcare providers and health plans, but “reducing cost in healthcare means reducing revenue for some.”

Healthcare purchasers can’t continue to handle year-to-year increases that are greater than inflation, she added.

“Reforms are needed,” she wrote. “They will not be easy, they will often be unpopular with healthcare providers, drug companies and some plan sponsors, but they are essential.”

DeMars suggested that federal agencies explore increasing the caps on health savings accounts and give workers more flexibility on how they can use their funds.

She noted that restrictions with health savings accounts can undermine some healthcare innovations. For instance, employers have to charge the fair market value of services in workplace clinics and can’t offer the care there for free to employees with the accounts.

DeMars said that policymakers should also consider making meaningful cost and quality information more available. And she called for clarifying wellness rules so employers know the parameters as they work on new approaches to improve workers’ health.

Ending the Affordable Care Act’s Cadillac Tax, a penalty on expensive employer-sponsored health plans, could also help. Congress recently delayed the tax, but it could end up penalizing businesses in the future for pursuing workplace clinics, wellness programs and other steps they’re taking to reduce healthcare costs, she said.